Dec 1, 2019

If we look back to 2016, 2017, 2018 and now also 2019 we have seen that a funded ICO smart contract is usually in control of a few people within the management that could be on a Ledger Nano. Only some ICO teams were more sophisticated and hired Lawyers to host the cold storage or engaged early blockchain banks to receive the digital currency funds on their cold storage in behalf of the ICO Team. But at this time no one really cared about the deployment of the smart contract itself - most of the times this was also overseen by the ICO Team there for they made sure everything has been tested properly and also audited from external parties, but once again the deployment itself was always done by a single individual within the team with lets assume a shared private key.

But our question, how should this look like now in the end of 2019 and also in the future?

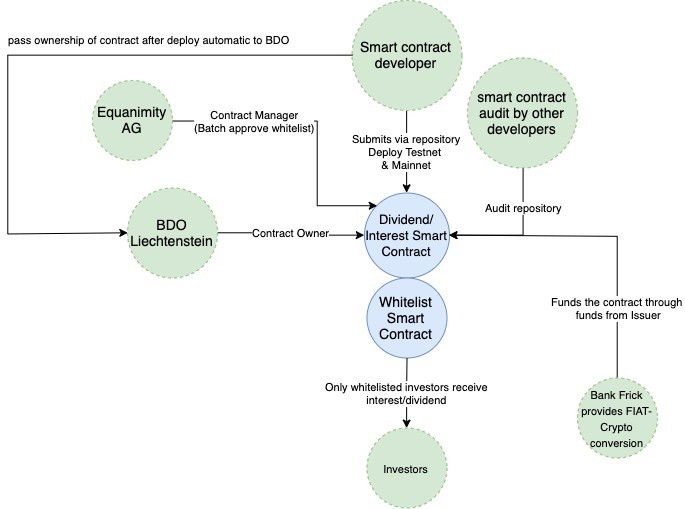

We recently created a graphic showing the example of how it has been done until now along with the potential roles in the TVTG (blockchain law in Liechtenstein)

whereby this graphic nearly all the ownership, obligations are within the ICO team - which could result in some dilemmas if the project moves into a direction for example which is not beneficial for the project and therefore its investors. We had many internal brainstorming hours on how the perfect solution could look like for the token issuer which in our case is always the Company incorporated in jurisdiction Liechtenstein and responsible for the token issuance in coordination with other roles like us for the technical project management.

We believe future issuances should follow this structure

Please note that also here we used the upcoming roles within the blockchain law which will take place in January 2020 in Liechtenstein. Besides the Bank, Trustee, Consulting firm and other project managers - your biggest asset in compliant offerings will be your lawyer. We have the honor to work together with one of the leading lawyers in Liechtenstein when it comes to issuing tokenised equity, bonds, convertibles or other financial instruments Dr. Florian Scheiber. This article was also inspired by one of the brainstormings we had together with Dr. Scheiber with regards to who should own & manage all smart contracts in a perfect issuance. We will also plan further collaboration together with Dr. Scheiber to make sure that we as a potential token generator as Equanimity AG will always stay ahead with regards to the law but also on the technical level.

But what's next after your issued your token?

Many of the questions go hand in hand while you develop your initial STO smart contract where the token itself is generated and how this will interact with potential dividend or interest payment smart contracts as you outlined in your prospectus - the appreciation for your investors? Who should own here which smart contracts and how will it work anyway? For the Investor it will be rather straight forward he just needs to be KYCed and registered in the investor dashboard to claim those dividends or interest payments. On the technical level - the smart contract needs to be secure and also deployed and funded so 4 critical steps. Creation, deployment, the funding & including distribution.

This graphic should visualize them.

[caption id="attachment_703" align="aligncenter" width="685"]

Structure Workflows STO Template-Smart Contract Owners[/caption]

So if you want to issue your financial instrument through the jurisdiction Liechtenstein, make sure you work together with the best in class so that your investors appreciate this in terms of trust. Below are also the recent potential roles and service providers within the TVTG (blockchain act).

We congratulate Liechtenstein as well for passing the blockchain law which will take effect in january 2020.

[caption id="attachment_663" align="aligncenter" width="502"]

equanimity congratulates liechtenstein to the blockchain act[/caption]Are you planning to issue a token in Liechtenstein and still have questions? Get in touch with us.