Nov 1, 2019

How far are we from tokenizing equity becoming mainstream?

We personally see there are many benefits to tokenizing the equity of an existing or a new company. Either when you are trying to pool a certain investor group into an SPV or preparing your next big fundraising after your family and friends round was done the traditional way, to tokenise equity especially helps in the administration of many small investors. For this reason, it's best to start early. But where do you start? The most important thing is to create your audience early; that could be investors, family, early customers and suppliers. They are the most valuable assets troughout your fundraising process over the next decade.

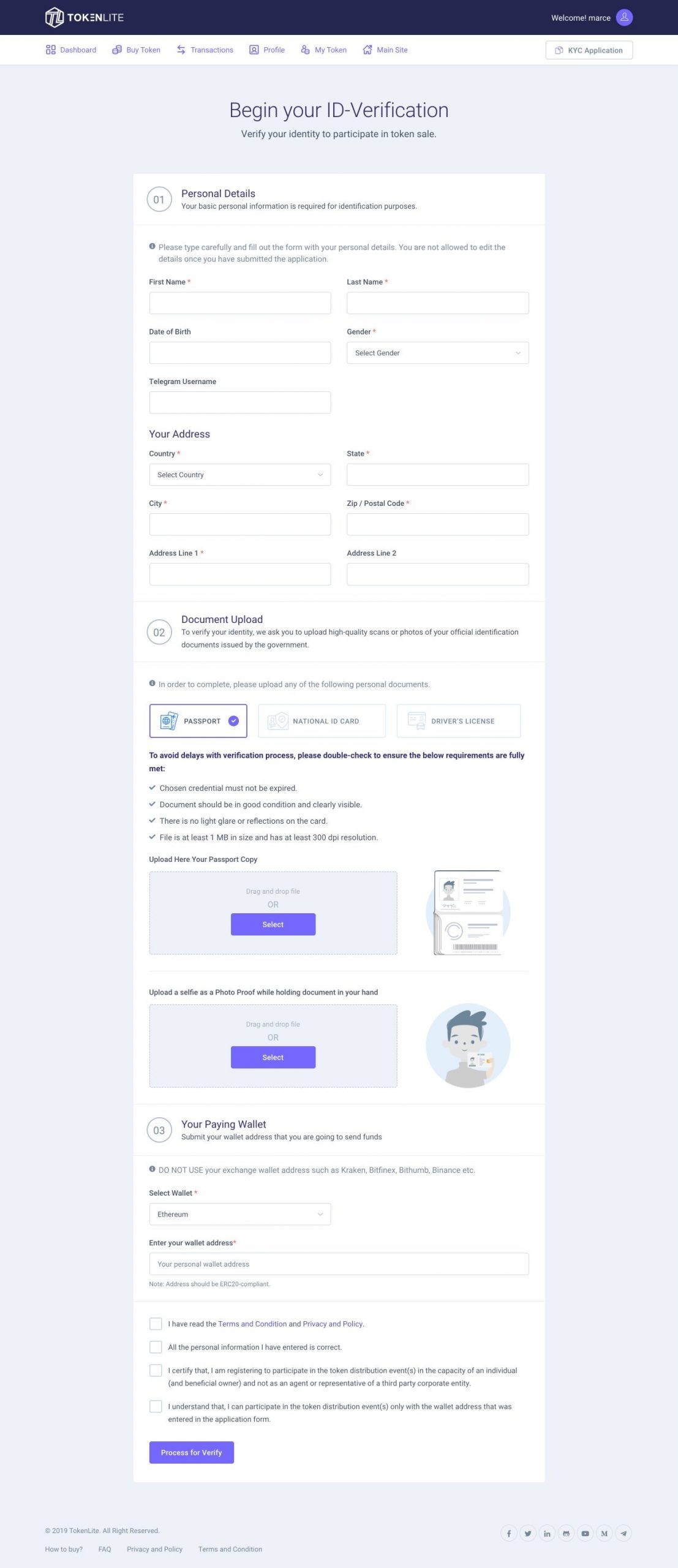

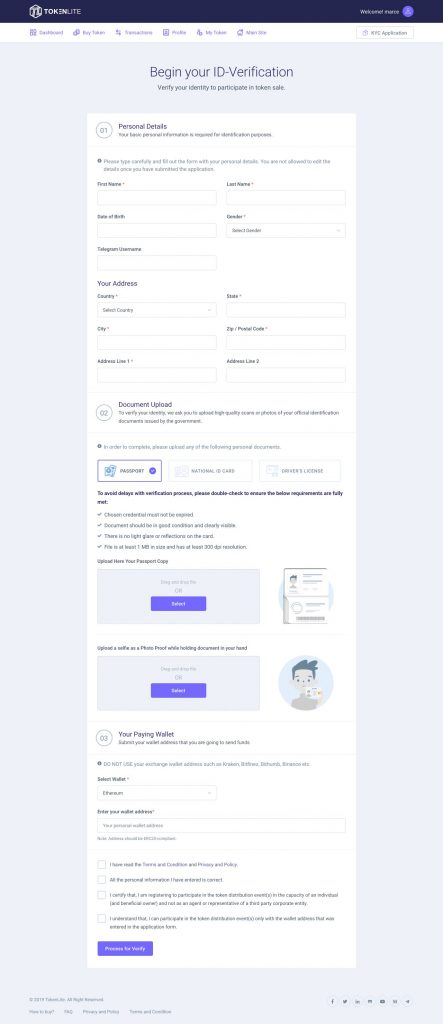

Choose an Investor Dashboard (KYC/AML)

Suddenly you need to manage your investors better and especially make sure to stay fully compliant within the jurisdiction where your company is incorporated. For this, you have 2 options: first, you either buy a ready-made KYC template which is not customized to your needs but could easily help you deploy and let potential investors sign up through the interface.

Or get a ready-made solution for your jurisdiction

This can be an option if you have a great budget and enough time to prepare a specialized way you want to engage with your future Investors. We at Equanimity AG have the philosophy to execute fast– if you want to have a ready-made solution for within the Liechtenstein jurisdiction for tokenizing equity, convertible bonds, feel free to reach out to us. We are very flexible, sharing the repository access so you can deploy it for yourself, especially if you are a promising entrepreneur who just needs help to get things going into this direction. If you need a last legal inspection, we can also help you with that through our partner, Florian Scheiber, who owns the firm Scheiber Law.

Now that Investors are onboarded, what's next?

Once you are in a position where future investors are willing to subscribe to your offering, you should have sufficient compliance in space to make sure that your procedure regarding KYC and AML meet the highest standards. If you choose the wrong partner regarding compliance, you might end up having difficulties exchanging your Bitcoin or Ethereum into USD/CHF/EUR. Don't make this rookie mistake and focus on your compliance. If you want a second opinion, feel free to reach out to us—we usually work together with BDO Liechtenstein and their internal compliance department, along with guidelines from other financial institutions you work with (e.g. Banks or Digital Assets Exchanges).

Smart contracts and automation

So, once the first investors are fully ready to invest, which is an approved KYC Status within your Investor Dashboard, you can provide them with information to invest in your offering; e.g. through providing the smart contract, address of the contract which is a reflection of the offering document. For example, an approved prospectus or any other Simple Agreement for Future Tokens (SAFT), if you do a more private and discreet funding round. ESMA recently also updated their Q&A regarding the new prospectus regime within the European Union which should make it easier for SMEs, and entrepreneurs to structure offer documents in a more straight-forward way, which should also be faster.

Please note that if you are accepting Bitcoin and FIAT, your investor dashboard needs to also support this so that you don't end up doing a lot of manual work. We believe in the ERC-20 standard from Ethereum regarding such offerings it can work for tokenizing equity, and tokenizing other financial instruments like Bonds or Convertible Bonds. But you have to also make sure to fully comply with local regulations and anti-money laundering practices. (e.g try to solve any questions to always know who owns the token :)) if you don't want to do the research and development yourself, reach out to us! We love to work with Entrepreneurs.

Conclusion

make sure your compliance is in place (KYC/AML)

make sure you engage with your investors as early as possible

make sure you have your technical setup (smart contracts, etc.) in place

engage with your investors not only before but after the offering through the investor dashboard

choose the right jurisdiction.

P.S. If your offering is outside of Liechtenstein and you already have all the legal, compliance and technical to-dos outlined please get in touch with us! We are eager to acquire this knowledge if the jurisdiction is promising.

Subscribe for occasional informational mail about new offerings we're working with.

[mc4wp_form id="352"]